Increase Cash Flow with the Employee Retention Tax Credit

What is the Employee Retention Tax Credit?

The Employee Retention Tax Credit (ERTC) is a refundable tax credit that was created as an incentive for business owners impacted by the pandemic to keep their staff on payroll. The ERTC was first enacted on March 28, 2020, as part of the CARES Act. The Consolidated Appropriations of 2021 (“CAA) and the American Rescue Plan Act of 2021(ARPA) both extended and significantly expanded the ERTC. The improvements help alleviate employers’ concerns about liquidity. Provisions to the ERTC include increased credit amount, less restrictive eligibility requirements, and retroactively allows certain PPP loan borrowers to claim the credit. Additionally, employers can now also request an advance payment of the credit due.

Who is eligible for the ERTC?

Employers of business and tax-exempt organization can qualify for the tax credit if one of the following events occurred in the period for which the credit is claimed:

- The operations of trade or business were either fully or partially suspended by orders from the federal, state, or local government that limited commerce, travel, and group meetings due to the pandemic.

- The business experienced a significant decline in gross receipts.

The Americal Rescue Plan Act (ARPA) expanded eligibility to an additional category of eligible employers referred to as “recovery start-up businesses”. This new category includes new businesses that began operation after February 15, 2020. The tax credit for these employers will be limited to $50,000 for any calendar quarter.

What is a significant decline in gross receipts?

A “significant decline in gross receipts” is defined differently for 2020 credits and 2021 credits.

2020 ERTC. Under the CARES Act, a significant decline in gross receipts is calculated by determining the first calendar quarter in 2020 where the gross receipts are less than 50% of the gross receipts for the same calendar quarter in 2019. The significant decline in gross receipts ends following the first calendar quarter where the quarterly gross receipts are greater than 80% of the gross receipts for the same calendar quarter in the prior year.

| Quarter | 2020 Gross Receipts | 2019 Gross Receipts | % of Prior Year |

| Q1 | $95,000 | $215,000 | 44% |

| Q2 | $185,000 | $225,00 | 82% |

| Q3 | $225,000 | $245,00 | 92% |

2021 ERTC. In 2021 a significant decline in gross receipts is calculated by determining the first calendar quarter in 2021, where the gross receipts are less than 80% of the gross receipts for the same calendar quarter in 2019. Employers may elect to compare the immediately preceding calendar quarter to calculate the decline in gross receipts. The significant decline in gross receipts ends following the first calendar quarter where the quarterly gross receipts are greater than 80% of the gross receipts for the same calendar quarter in the prior year.

| Quarter | 2021 Gross Receipts | 2019 Gross Receipts | % of 2019 |

| Q1 | $155,000 | $205,000 | 76% |

| Q2 | $235,000 | $225,000 | 104% |

How much is the Employee Retention Tax Credit (ERTC) worth?

The amount of the ETRC depends on the time period for which the credit is claimed. The credit amounts are different in 2020 and 2021.

2020 ERTC. Under the CARES Act, the amount of the Employee Retention Tax Credit was limited to 50% of the first $10,000 of qualified wages paid to the employee from March 13, 2020, to December 31, 2020. This means that the maximum amount that could be credited back to the employer was $5,000 per employee.

2021 ERTC. In 2021 the ERC is equal to 70% of qualified wages paid to an employee, up to $10,000 in wages per employee for each quarter from January 1, 2021, to December 31, 2021. The maximum credit that can be claimed for each employee per quarter is $7,000. An employer could receive up to $28,000 for each employee in 2021.

The tax credit can be applied to the wages of an employee in 2021 even if the tax credit was applied to the wages of the same employee in 2020. Example below:

| Period | Qualified Wages | Tax Credit Amount |

| Q3 2020 | $10,000 | $5,000 |

| Q4 2020 | $10,000 | $5,000 |

| Q1 2021 | $10,000 | $7,000 |

| Q2 2021 | $10,000 | $7,000 |

| tax credit total | $19,000 |

What are qualified wages?

The rules for determining which employees’ wages qualify differ for 2020 credit and 2021 credits. First, the employer must determine the number of full-time equivalent employees for 2019. A full-time equivalent employee is an employee who worked an average of at least 30 hours per week or 130 hours in a month, in any calendar month of 2019.

2020 ERTC. Employers with 100 or fewer full-time equivalent employees during 2019 – Qualified wages include all wages and health plan expenses paid to the employees during a period where the operations were suspended or there was a significant decline of receipts regardless of whether the employee performed services for the employer.

Employers with more the 100 full-time equivalent employees during 2019- Qualified wages include all wages and health plan expenses paid to the employees that are not providing any services to the employer because operations were suspended or there was a significant decline of receipts.

2021 ERTC. In 2021 the qualified wages for the purpose of ERC for an employer with 500 employees or less include all wages and health plan expenses paid to the employees during a period where the operations were suspended or there was a significant decline of receipts regardless of whether the employee performed services for the employer. Employers with more than 500 employees can only apply the credit to wages paid to an employee not providing any service.

The ARP also changed the definition of qualified wages for “severely financially distressed “employers. Which includes employers that can demonstrate that they have a 90% decline in gross receipt when comparing a calendar quarter in 2021 to the same calendar quarter in 2019. These employers can count all wages regardless of the size of the business or the number of employees.

ARPA changes to the ERC only apply to wages paid in the last two quarters of 2021.

How is the ERTC refundable credit claimed?

The ERTC is claimed on the quarterly payroll tax return, form 941. Employers can access their ERTC by reducing the required deposits of employment taxes including federal income tax withholding, the employees’ share of Social Security and Medicare taxes, and the employer’s share of Social Security and Medicare taxes for all employees, up to the amount of the credit, without penalty.

For 2021 the employer can request an advanced payment of the ERTC with the 7200, Advance of Employer Credits Due to COVID-19.

Can I qualify for the ERTC if I received a PPP Loan?

Yes, the law now allows employers who received Paycheck Protection Program (PPP) loans to claim the ERC for qualified wages that are not treated as payroll costs in obtaining forgiveness of the PPP loan.

The credit can be claimed retroactively for wages paid after March 12, 2020 that were not covered by proceeds of a forgiven PPP loan.

Partner with a Trusted Tax Accountant at Eco-Tax

We at Eco-Tax are ready and here to support you through it all. To learn more about how our employee retention credit services could help you, contact us today to book a free consultation with one of our trusted advisors. We look forward to partnering with you!

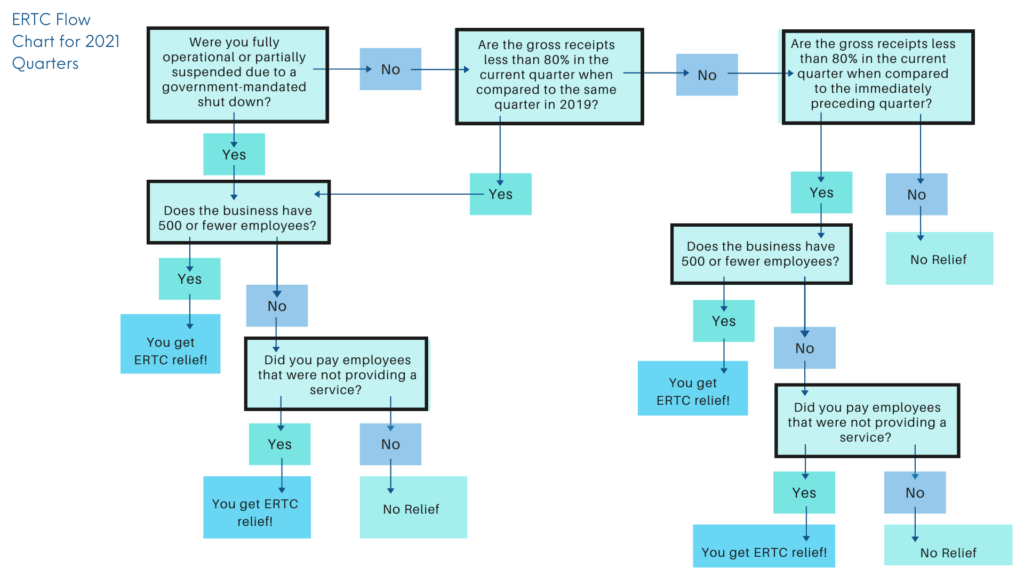

ERTC Flow Chart for 2021 Quarters