What you need to know about the Earned Income Tax Credit

In December 2020, Congress passed the “Taxpayer Certainty and Disaster Tax Relief Act of 2020,” which allows individuals to use their 2019 earned income instead of their earned income from 2020 to figure their Earned Income Tax Credit (EITC). This new “lookback” tax rule provides relief to the millions of Americans that lost their jobs or experienced a significant drop in their earned income in 2020. Taxpayers who only had unemployment income in 2020 can use their 2019 earned income to qualify for the EITC.

The American Rescue Plan Act, recently passed by the House of Representatives, proposes new changes to the Earned Income Tax Credit to make it even more accessible to Americans in need of financial assistance. The bill would expand the age range of taxpayers that can qualify for the credit and increase the income threshold limitations for childless workers.

What is the Earned Income Tax Credit?

The Earned Income Tax Credit (EITC) is a federal refundable tax credit that helps millions of taxpayers with low to moderate earned income. The EITC amount depends on several factors, including income, family size, and filing status. Taxpayers that are not married or have no children may also claim the credit. The credit amount is greater for taxpayers that have one or more children who live with them for more than half the year and meet other requirements.

The EITC can give the taxpayer a financial boost by reducing the amount of taxes owed on a dollar-for-dollar basis. If the amount of the credit due exceeds the amount of the taxes owed, the taxpayer will receive a refund. For example, a taxpayer with a tax bill of $4,000 that qualifies for a $5,000 tax credit will get a refund of $1000.

How much is the EITC?

The credit amount given to the eligible taxpayer will depend on their filing status, annual income, and the number of qualifying children. The maximum earned income tax credit amounts are:

- $538 with no qualifying children

- $3,584 with one qualifying child

- $5,920 with two qualifying children

- $6,660 with three qualifying children

How will the new bill change the EITC?

- The new bill would raise the maximum credit for adults with no children to $1,500.

- It would raise the income threshold for single childless workers to $21,427 per year ($27,367 for childless married workers).

- It also plans to expand the eligible age range allowing younger and older taxpayers to participate in the program. Taxpayers as young as 19 can apply instead of 25. It would remove the current age restriction of 65 so that older taxpayers can also receive credit.

Who qualifies for the EITC?

To obtain the credit you must meet these basic qualifications:

1- Have a Valid Social Security Number – To claim the EITC, you (and your spouse, if filing jointly) must have obtained a valid social security number before the tax return’s due date (April 15th, 2020). Additionally, all qualifying children must also have a valid social security number by the same date.

2- Not File Married Filing Separately – To claim the EITC, you must have one of the following filing statuses 1. Single, 2. Married Filing Jointly, 3. Head of Household, or 4. Qualifying Widow. You can’t claim the EITC if your filing status is Married Filing Separately. If your spouse hasn’t lived with you in the last six months of the year, you may file Head of Household to qualify for the credit.

3- Not File Form 2555 – Those who earned foreign income and need to file the form 2555 can’t claim EITC.

4- Meet Investment Income Limitation – Your investment income must be $3,650 or less in the year you claim the credit. Investment income can include income derived from stock dividends, rental properties, inheritance, and royalties.

5- Must be a U.S. citizen or U.S. Resident All year – You could not claim the EITC if you were a nonresident alien for any part of the year. If you are a nonresident alien married to a U.S. Citizen or U.S. Resident and filed jointly, you can claim the tax credit.

6- Have Earned Income – To qualify for the EITC, you must have earned income. If you file jointly, only one spouse must have earned income to be eligible for the credit.

Taxpayers who have earned income through self-employment or by working for someone else may qualify for the credit. Some examples of earned income include:

- Wages, salary, and tips

- Gig economy work

- Self-employment earning from own a business or farming.

- Disability retirement payments received before you reach the minimum retirement age

The following types of income do not qualify as earned income:

- Interest and dividend

- Pension and annuities

- Social security

- Alimony

- Child support

- Unemployment benefits

- New Tax Relief

7- Adjusted Gross Income (AGI) Limits – The Adjusted Gross Income (AGI) limits are adjusted every year. Your Adjusted Gross Income must be less than the amount listed below to claim the EITC:

Married filing jointly filers AGI limitation is:

- $21,710 if you have no qualifying children

- $47,646 if you have one qualifying child

- $53,330 if you have two qualifying children

- $56,844 if you have three qualifying children

Single, Head of Household, and Qualifying Widow filers AGI Limitation is:

- $15,820 if you have no qualifying children

- $41,756 if you have one qualifying child

- $47,440 if you have two qualifying children

- $50,954 if you have three qualifying children

Eligibility for the credit may change from year to year and can be affected by significant life changes such as:

- A new job or loss of a job

- Unemployment benefits

- A change in income

- A change in marital status

- The birth or death of a child

- A change in a spouse’s employment situation

What are the criteria for a qualifying child?

If you want to claim your children, they must pass the following tests to qualify:

Relationship test: The child must be a son/daughter, stepchild, sibling, foster child, or grandchild.

Age Test: At the end of the tax filing year, the child must be under 19 and younger than you (and your spouse if filing jointly). A child under the age of 24 that is a full-time student (for at least five months of the year) can also qualify. If the child is permanently or was disabled at any time in 2020, there is no age restriction.

Residency Test: the child must have lived with you in the U.S. for more than half of the year.

State and Local Earned Income Tax Credits

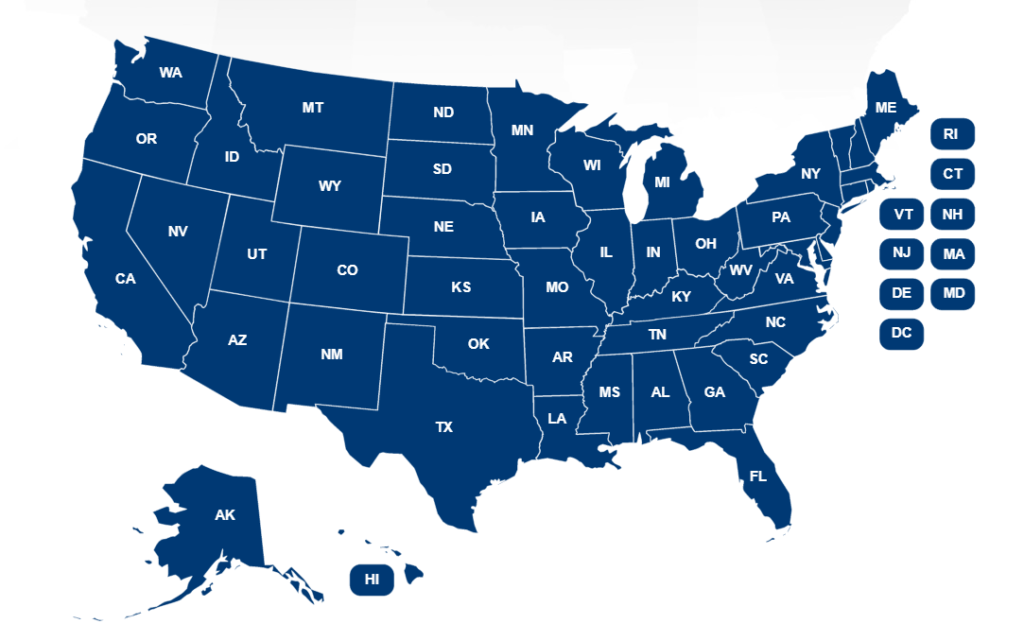

Twenty-eight states, the District of Columbia, and New York City have enacted their own Earned Income Tax Credit. The State EITC reduces the state income tax liability. The eligibility standards, credit amount calculation, and refundability vary from state to state. Generally, the State EITC is based on a percentage of the federal EITC. Only the states of Delaware, Main, Ohio, and Virginia do not offer refundable credits. (click to view states with earned income tax credits).

Find out if you are eligible for this credit. Schedule a free tax consultation to speak with one of our advisers.