Closing a Business

More than 100,000 small businesses have closed due to COVID-19. There is more to closing a business than laying off employees, selling office furniture, and closing the doors. Owners of closing businesses must take certain actions as required by the IRS to fulfill your tax obligations. For example, if your business has employees, you must file final employment tax returns as well as make final federal tax deposits of these taxes. You must also file an annual tax return for the year you go out of business. You also need to attach a statement to your return listing the name and address of the person that keeps the payroll records (this could be you or another person). If you are disposing of business property, exchanging like-kind property, and/or changing the form of your business, you must file a return to report these actions.

Steps to closing a business include but are not limited to the following:

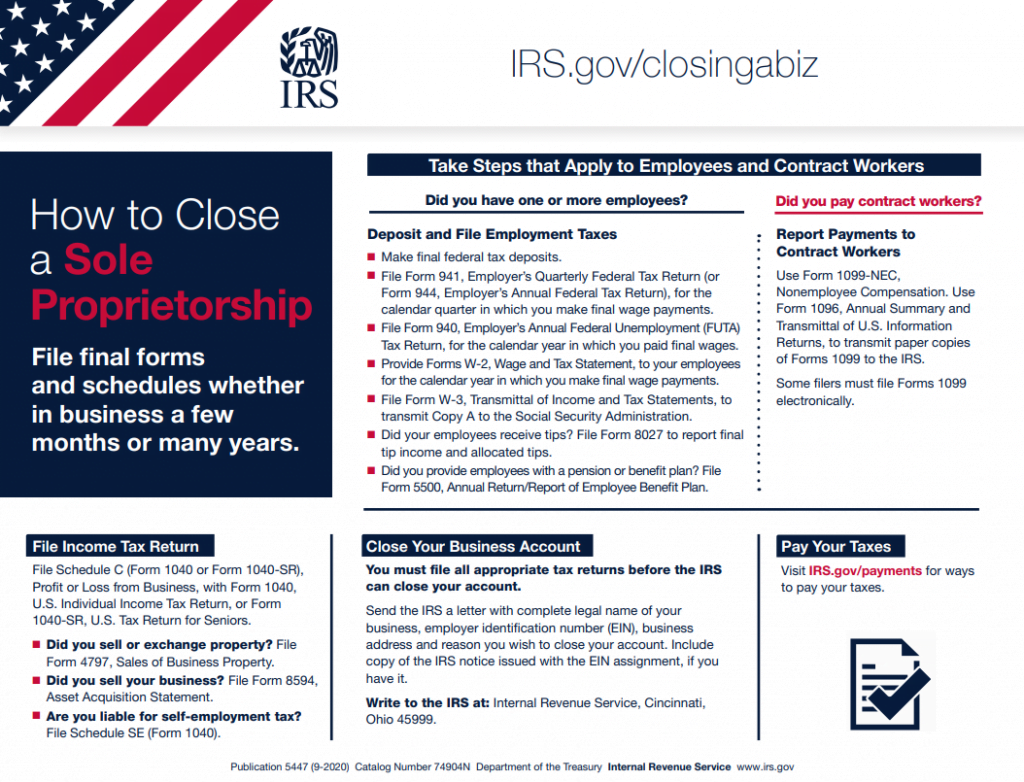

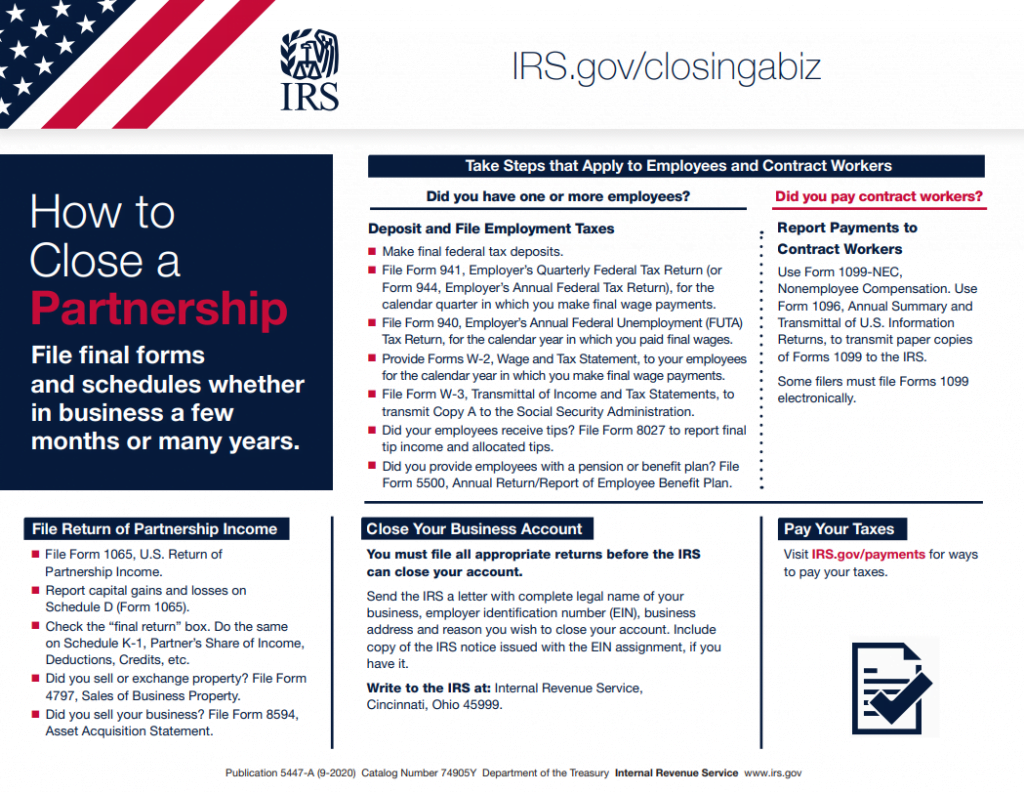

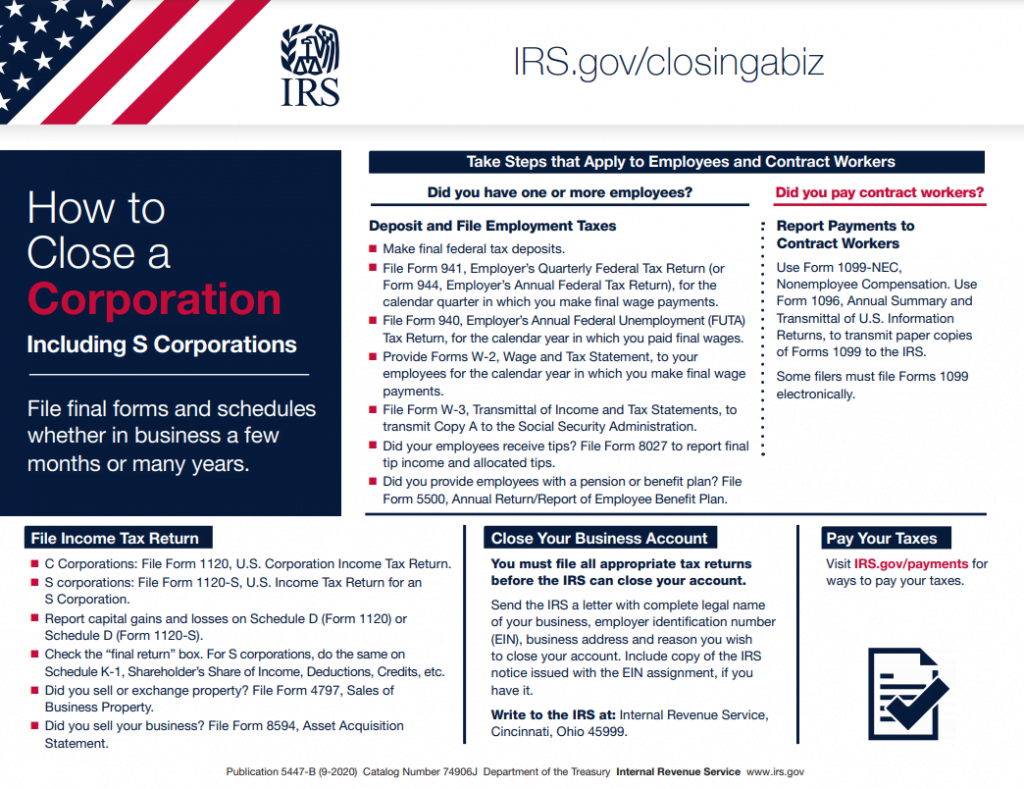

- File a Final Return and Related Forms. The type of return to file depends on whether the business is a sole proprietorship, partnership or corporation. The page features a section for each business type. Business owners can click on the section that applies to them to get the returns and forms they need.

- Take Care of Employees. Business owners with one or more employees must make final federal tax deposits and report employment taxes.

- Pay the Taxes Owed. Even if the business closes now, tax payments may be due next filing season.

- Report Payments to Contract Workers. Businesses that pay contractors at least $600 for services (including parts and materials) during the calendar year in which they go out of business, must report those payments.

- Cancel EIN and Close IRS Business Account. The IRS cannot close out an account until the business has filed all necessary returns and paid all taxes owed.

- Keep Business Records. How long a business needs to keep records depends on what’s recorded in each document.

Click to view IRS PDF “How to close a Sole Proprietorship”