Year-End Tax Planning: Checking Your Paycheck Withholding

While it might seem like tax season just ended, it is never too early to do a “Paycheck Checkup” to make sure the right amount of tax is withheld from earnings – and avoid a tax surprise next year when filing your 2020 tax return. As a reminder, because income taxes operate as a pay-as-you-go system, taxpayers are required by law to pay most of their tax as income is received.

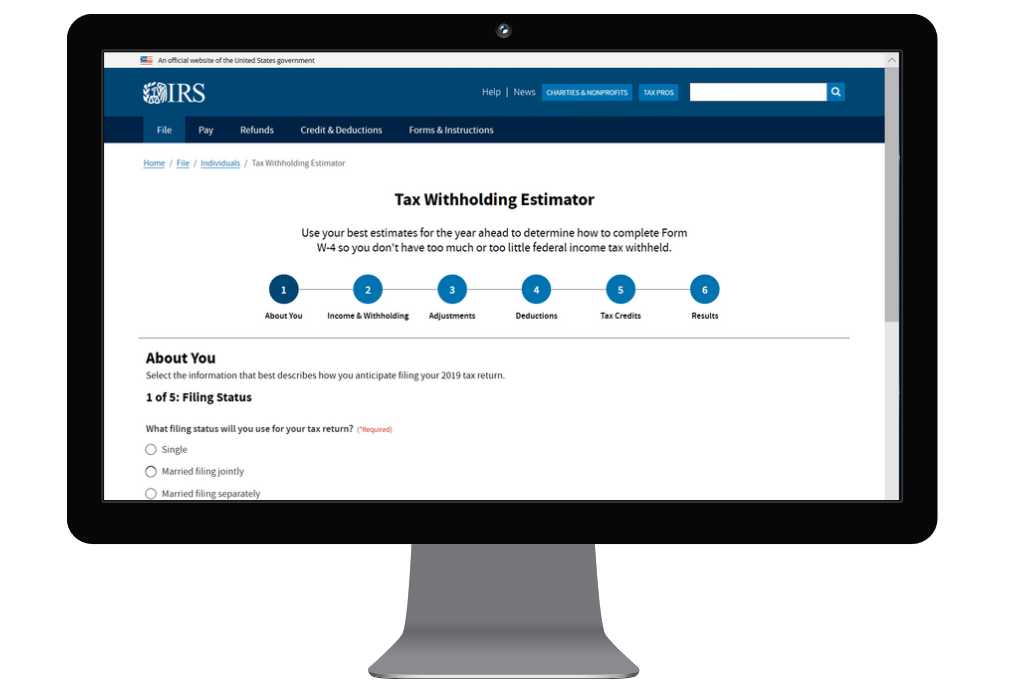

Income tax withholding is generally based on the worker’s expected filing status and standard deduction. The Tax Withholding Estimator is a tool on IRS.gov designed to help taxpayers determine how to have the right amount of tax withheld from their paychecks. It allows workers, retirees, self-employed individuals, and other taxpayers to enter their information using a clear, step-by-step method that helps them determine if there is a need to adjust their withholding and submit a new Form W-4, Employee’s Withholding Certificate, to their employer.

Who Should Check Income Tax Withholding?

People who should check their withholding include anyone who:

- is part of two-income families

- works two or more jobs or who only work for part of the year

- has children and claims credits such as the child tax credit

- has older dependents, including children age 17 or older

- itemized deductions on their 2019 tax return

- is a high-income earner with a complex tax return

- received a large tax refund or had a substantial tax bill for 2019

- receives unemployment at any time during the year

When To Do a Paycheck Check-Up

Taxpayers should check their withholding annually and when life changes occur, such as marriage, childbirth, adoption, and buying a home. The IRS recommends anyone who changed their withholding this year or received a tax bill after they filed their 2019 return should do a Paycheck Checkup.

There are a number of different types of payments that taxpayers should check their withholding on including:

- Unemployment compensation includes: Benefits paid by a state or the District of Columbia from

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

Unemployment Compensation

By law, unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted this spring.

Millions of Americans currently receiving unemployment compensation (and for many individuals, an extra $600 in addition to regular unemployment benefits) may not realize that unemployment benefits are considered taxable income by the IRS and that tax should be withheld now to avoid owing taxes on this income when filing a federal income tax return next year.

Withholding is voluntary; however, federal law allows any recipient to choose to have a flat 10 percent withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request (PDF), and give it to the agency paying the benefits. Do not send it to the IRS. If the payor has its own withholding request form, use that form instead.

Recipients who return to work before the end of the year can use the IRS Tax Withholding Estimator to make sure they are having enough tax taken out of their pay.

In January 2021, unemployment benefit recipients should receive a Form 1099-G, Certain Government Payments (PDF) from the agency paying the benefits. The form will show the amount of unemployment compensation they received during 2020 in Box 1, and any federal income tax withheld in Box 4. Taxpayers report this information, along with their W-2 income, on their 2020 federal tax return.

Paying Estimated Taxes

Taxpayers with a substantial portion of their income not subject to withholding − the self-employed, investors, retirees, those with interest, dividends, capital gains, alimony, and rental income − often need to pay quarterly installments of estimated tax.

Recipients of unemployment compensation that don’t choose to withhold – or realize that the amount withheld is not enough – can also make quarterly estimated tax payments. The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively.