Taking Advantage of the Home Office Deduction

More people are working from home than ever before, taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. Here are some tips to help you understand the home office deduction and determining whether you can claim the home office deduction on your tax return:

Who qualifies?

A self-employed taxpayer (sole proprietor, independent contractor, and certain partnerships) who uses a home office for business can be eligible to claim the home office deduction, which permits the deduction of certain home expenses on their tax return. The benefit to this, of course, is that it can reduce the amount of your taxable income. Due to the TCJA employees aren’t eligible to take the home office deduction – even if you are working remotely in your home office.

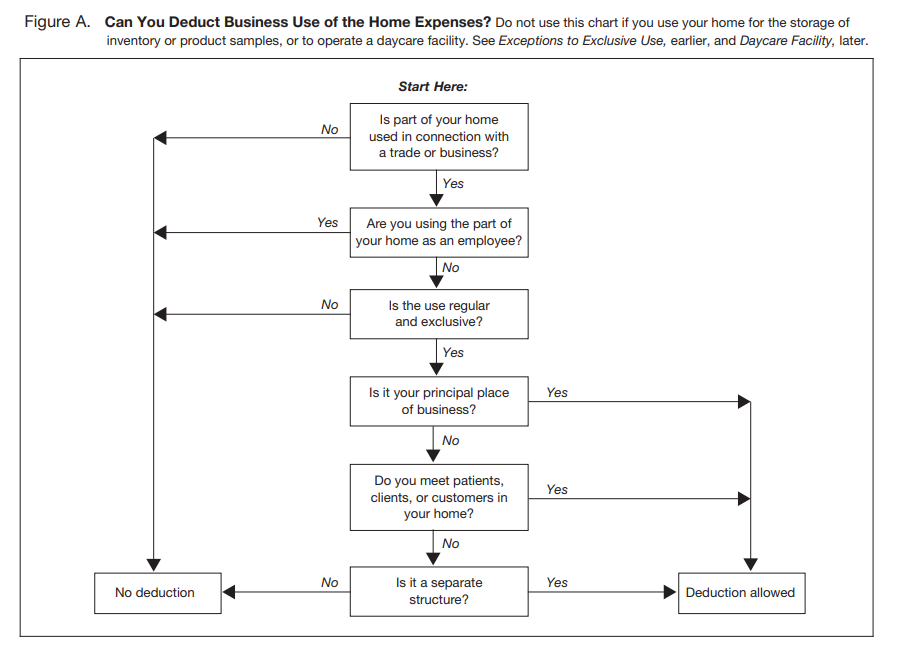

To qualify for the home office deduction your home must meet two basic requirements:

- Regular and Exclusive Use– There must be the exclusive use of a portion of the home for conducting business on a regular basis. For example, a taxpayer who uses an extra room to run their business can take a home office deduction only for that extra room so long as it is used both regularly and exclusively in the business.

- Principal Place of Business– The home must be the taxpayer’s principal place of business. A taxpayer can also meet this requirement if administrative or management activities are conducted at the home and there is no other location to perform these duties. Here are a few examples of administrative activities billing customers, clients, or patients, Keeping books and records, ordering supplies. setting up appointments. forwarding orders or writing reports. Therefore, someone who conducts business outside of their home, but also uses their home to conduct business may still qualify for a home office deduction.

The home office deduction is available to both homeowners and renters. The term “home” for purposes of this deduction is defined as a house, apartment, condominium, mobile home, or similar property. It also includes structures on the property such as an unattached garage, studio, barn, or greenhouse. Expenses that relate to a separate structure not attached to the home qualify for a home office deduction only if the structure is used exclusively and regularly for business.

What can you deduct?

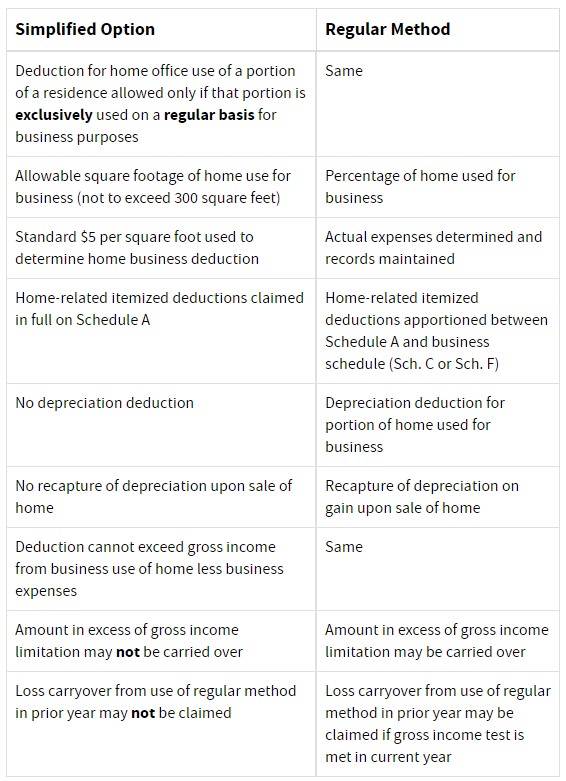

Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction, the simplified and regular method. Taxpayers can alternate between methods from year to year.

Regular Method (Actual Expense Method)

You must divide the expenses of operating your home between personal and business use. The part of a home operating expense you can use to figure your deduction depends on both of the following.

- Whether the expense is direct, indirect, or unrelated.

- The percentage of your home used for business.

Direct vs. Indirect Expenses

The IRS divides the home office expenses into two categories:

- Direct Home Office Expenses- You have a direct home office expense when you pay for something that is just for the home office. This includes for example painting your home office. The entire amount of this type of home office expense is deductible.

- Indirect Home Office– An indirect expense is a payment for something that benefits your entire home, including both the home office portion and your personal space. You may only deduct the portion that applies to your home office- it is limited to the home office business use percentage.

Most of your home office expenses will be indirect expenses, for example:

- rent

- home mortgage interest, real estate property taxes, and depreciation

- utilities- electricity, gas, water, heating oil, and trash removal

- insurance

- repairs and maintenance- cleaning, repairing leaks, roof and furnace repairs, and exterior painting

- casualty loss- such as fire, floods, or theft

- condominium association fees

- insurance

- security system

Business Use Percentage

Deductions for a home office using the regular method are also based on the percentage of the home devoted to business use. Here are two commonly used methods of figuring out the percentage:

- Square Footage method– divide the square footage of your home office by the total square footage of your home. For example, if your home is 1,000 square feet and you use 250 square feet for your home office, then 25% of the total area is used for business.

- Room Method- with this method you divide the number of rooms used for business by the total number of rooms in the home (used if the rooms in your house are about the same size). Don’t include bathrooms, closets, or other storage areas. For example, if you have one-room used as an office in your five-room house, then 20% of your home is used for business.

Simplified Method

Allows a standard deduction of $5 per square foot for up to 300 square feet. Which means that the maximum deduction under this method is $1,500.

Limitations

You can’t deduct more than your net profit. If your deductions exceed your profits, you can deduct the excess in the following year (and in each succeeding year until you deduct the entire amount).

IRS Comparison of Methods

You can learn more by contacting your dedicated advisor.