Paycheck Protection Program Loan Forgiveness

Small business owners who have received the Paycheck Protection Loan can seek forgiveness of the PPP loan’s principal amount if it is spent on SBA authorized uses during the 8-week covered period.

Here’s what you need to know to qualify for loan forgiveness

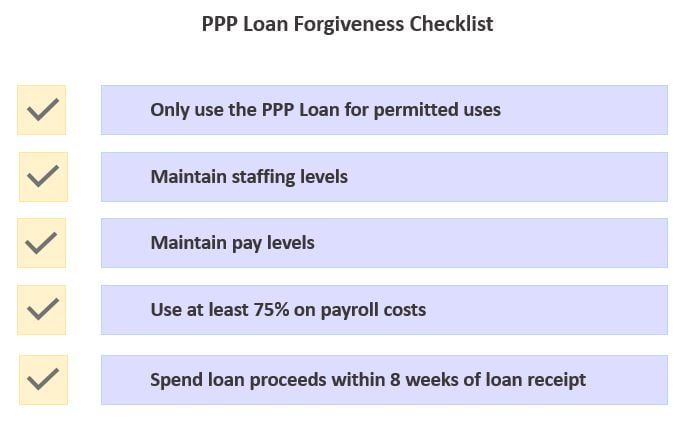

In order to maximize loan forgiveness small business owners must:

- review what loan uses will be forgiven

- understand how loan forgiveness can be reduced

- keep an accurate account of expenditures and provide documentation to lenders

- follow the lender’s guidelines

Follow Lender’s Guidelines & Keep Detailed Records

Understand your lender’s set of guidelines: Borrowers must provide required documentation that verifies the number of full-time equivalent employees and payroll reports. The Required documentation can also include but not limited to documents verifying eligible interest, rent, and utility payments (canceled checks, payment receipts, account statements). It’s important to verify what documentation the lender will require for the application of loan forgiveness, they may have additional requirements.

Consider setting up a separate bank account to track funds: It’s crucial to maintain a detailed account of how the loan is spent. It may be in your best interest to segregate funds in a separate bank account. Otherwise commingling the loan with other funds will make it very difficult to track and to document its use.

Proper use of PPP Funds & Avoiding Loan Forgiveness Reduction

Only use loan proceeds for authorized expenses

- Payroll costs including benefits

- Interest on mortgage obligations, incurred before February 15, 2020

- Rent, under lease agreements in force before February 15, 2020

- Utilities, for which service began before February 15, 2020

Maintain the same number of employees

Loan forgiveness will be reduced if you decrease your full-time employee headcount in comparison to the period prior to shutdown. The two pre-shutdown measurement periods you can select from are: the period commencing on February 15, 2019, and ending on June 30, 2019, or the period commencing on January 1, 2020, and ending on February 29, 2020.

Maintain the same level of payroll

Loan forgiveness will also be reduced if you decrease wages by more than 25% for any employee that made less than $100,000 annualized in 2019. The level of payroll must be the same as the period before shutdown (see above).

You have until June 30, 2020, to restore your full-time employment and salary levels for any changes made between February 15, 2020, and April 26, 2020.

Use at least 75% of the loan proceeds for payroll costs

Up to 25% of the loan proceeds may be used for non-payroll expenses.

Spend Loan Proceeds during the 8-week cover period

The 8- week coverage period begins on the day the PPP loans are disbursed to the borrower.

Follow Lender’s Guidelines & Keep Detailed Records

It’s important to know how to properly account for loan expenditures to apply for loan forgiveness.

Understand your lender’s set of guidelines

Borrowers must provide required documentation that verifies the number of full-time equivalent employees and payroll reports. The Required documentation can also include but not limited to documents verifying eligible interest, rent, and utility payments (canceled checks, payment receipts, account statements). It’s important to verify what documentation the lender will require for the application of loan forgiveness, they may have additional requirements.

Consider setting up a separate bank account to track funds

It’s crucial to maintain a detailed account of how the loan is spent. It may be in your best interest to segregate funds in a separate bank account. Otherwise commingling the loan with other funds will make it very difficult to track and to document its use.