Unemployment Insurance Benefits

How the CARES Act expanded Unemployment Insurance Benefits

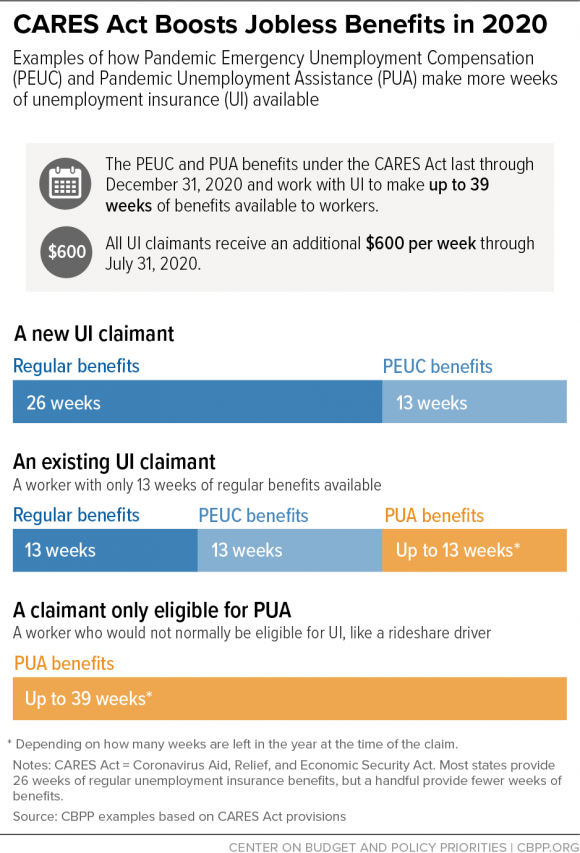

The CARES Act includes programs to expand unemployment benefits for regular beneficiaries and to those who would not normally receive these benefits, such as sole proprietors and self-employed individuals. Unemployment benefits are a lifeline for many who have lost work in the wake of the current health crisis. The Act includes the following federal programs:

- Pandemic Unemployment Assistance (PUA)

- Federal Pandemic Unemployment Compensation (FPUC)

- Pandemic Emergency Unemployment Compensation (PEUC)

What is Pandemic Unemployment Assistance (PUA)?

PUA program was designed to provide unemployment benefits to workers that are not eligible for regular unemployment insurance benefits. This program has extended benefits to self-employed individuals and others including:

- Sole Proprietors/ Single Member LLCs, Independent Contractors, Freelancers, 1099 workers, Gig workers, Ride-sharing drivers

- Employees whose wages are not reported for unemployment insurance

- Employees who have not earned enough wages or worked enough hours for regular unemployment benefits

What is Federal Pandemic Unemployment Compensation (FPUC)?

FPUC program authorized by the CARES Act provides an additional $600 per week to every person that qualifies for regular unemployment benefits or PUA, for up to 12 weeks and ends by July 31, 2020.

What is Pandemic Emergency Unemployment Compensation (PEUC)?

PEUC program provides up to 13 additional weeks of unemployment benefits for individuals who have exhausted regular unemployment benefits.

How to apply for benefits:

The new and expanded benefits will be administered through each state’s unemployment compensation program. Each state is responsible for establishing a system to address the CARES Act within the guidelines provided by the Department of Labor. Individuals seeking benefits must apply directly to the state. The time to process an application depends on where you live. There is an unprecedented number of claims that have overwhelmed the state’s systems. Even if it takes states additional time to process claims the benefits are made retroactively. It’s important to apply as soon as possible. When applying for benefits here is some information you will likely need to provide:

- Your Social Security Number

- Your State Driver License or Identification card

- Your Residential Address

- Proof of income: If you were employed, 2019 W-2s for all employers you worked for during that year; If you were self-employed, all 2019 Form 1099s; Schedule C from your 2019 tax return; bank statements

- Bank name, address, routing and account numbers if you want to use direct deposit