Third Stimulus Check Update: Find out how much you will get

The American Rescue Plan Act of 2021 authorized the third round of economic impact payments, also known as stimulus checks, for individuals and their dependents. These payments are non-taxable. Here are some frequently asked questions regarding eligibility, payment amount, income limitations, how payments will be delivered, and more.

When will the third round of stimulus checks be delivered?

The IRS will send stimulus checks via direct deposit, paper check, and by prepaid debit card. On March 17th, the IRS made funds available to banks and credit unions. Some payments were even made to individuals as early as the weekend of March 13 from banks that deposited funds for their customers. If the IRS does not have your bank account information on file, you may receive a paper check or a prepaid debit card by mail.

On Monday, March 22nd the IRS announced it began to issue millions of stimulus payments by paper check and prepaid debit card. You could receive this latest payment on a debit card even if you received previous Economic Impact Payments by check. Watch your mail carefully for paper checks and prepaid debit cards. They will arrive in a white envelope from the U.S. Department of the Treasury. The prepaid debit card, called the Economic Impact Payment card, is issued by MetaBank®, N.A. Each mailing includes instructions on how to securely activate and use the card. Learn more about the EIP card here.

How do you check the status of your stimulus check?

You can track the status of your payment by using the IRS “Get My Payment” online tool. This tool will show the status of the payment, the payment date, and the method of delivery (check, EIP card, or direct deposit). To use this payment tool, you will need to enter your social security number, date of birth, address, and zip code.

Who is eligible for the third round of stimulus checks?

The IRS looks at tax information from an individuals or couples 2019- or 2020-income tax return to determine eligibility and to calculate the payment amount. If the IRS does not have their tax information from 2020 when issuing payment, they will use the information from their 2019 tax return.

The IRS will deliver stimulus payments of up to $1,400 to each eligible individuals with an adjusted gross income that does not exceed the following amounts:

- $75,00 for individuals that file as single.

- $112,500 for individuals that file as head of household

- $150,000 for couples that file as married filing jointly.

A couple that files married filing jointly will get one payment of $2,800. However, if only one of the spouses has a Social Security Number, the payment amount will be $1,400 instead of 2,800.

How will the stimulus check be reduced for those earning above income thresholds?

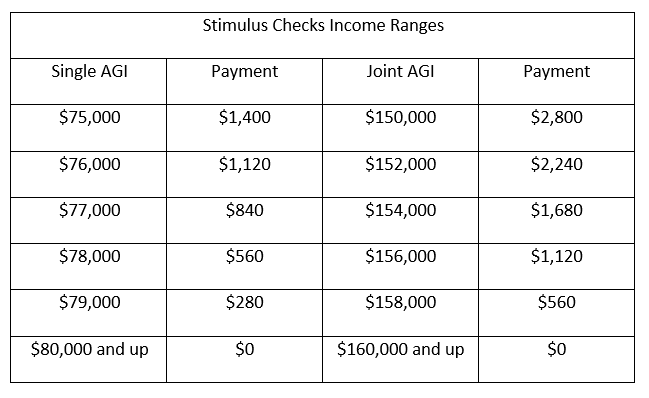

The third round of these payments excludes high-income earners by narrowing eligibility to target individuals that meet income limits. Individuals that have incomes that exceed thresholds will receive partial payment. The payment amount declines until it completely phases out for the following adjusted gross income (AGI) ranges:

- AGI ranges between $75,000 to $80,000 for individuals that file as single.

- AGI ranges between $112,500-$120,000 for individuals that file as head of household

- AGI ranges between $$150,000 to $160,00 for couples that file as married filing jointly.

How much will the payment be for dependents?

You can receive an additional $1,400 stimulus check for each dependent. For example, a couple that files jointly with three children and adult dependent could receive up to $8,400. Dependents include qualifying children and adult dependents, including college students, disabled adults, and the elderly. The taxpayer claiming the adult-dependent receives the stimulus payment.

What if the first or second stimulus checks were not received?

The stimulus checks were advance payments of a 2020 tax credit called the “Recovery Rebate Credit”. This tax credit is based on tax return information from 2020. If you have not received the first or second stimulus payment you may be able to claim the recovery rebate.

Some individuals did not receive the advance payment or received a partial payment because IRS used tax information from an individuals or couples 2018- or 2019-income tax returns to determine eligibility and to calculate the payment amount. The first stimulus check of $1,200 (plus $500 for each qualifying child) was based on tax information from 2018 or 2019. The second stimulus check of $600 (plus $600 for each qualifying child) was based on the 2019 tax information (if available).

Many factors could have changed in 2020 that affect eligibility, including income change, having more children, having been issued a Social Security Number, or no longer a dependent in 2020. You must file a 2020 tax return to claim the recovery rebate tax credit. If you do not receive the third economic payment, you can claim a rebate tax credit on your 2021 tax return.

The IRS sent out notices 1444 and 1444-B to inform eligible individuals about the first and second economic payments. These notices include information about what payments were made, their amounts, and how they were delivered. The information from these letters will be used to determine the amounts to include in your Recovery Rebate Credit Worksheet.

If you don’t have your notices, you can view the amounts of your first and second Economic Impact Payments through your online account.