Paycheck Protection Program

What is the Paycheck Protection Program?

On March 27, The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by the house of representatives and then signed into law by the President. The Cares Act provides $2 Trillion in emergency financial assistance to individuals, small businesses, large corporations, hospitals, health centers, state, and local governments that are impacted by the coronavirus. The stimulus package provides $350 billion to fund a new Small Business Administration (SBA) lending program the Paycheck Protection Program. It significantly increases funding, expands flexibility, and loan guarantees. The PPP gives small businesses and non-profits the opportunity to obtain working capital needed to weather the crisis and aid in their recovery. Moreover, the PPP intends to provide an incentive for businesses to retain their employees by offering forgivable loans with a 100% guarantee.

SBA Approved Lender

Only SBA authorized lenders can offer PPP loans. These banks have the necessary qualifications to process, close, and disburse loans. The approved lenders are now accepting applications. Its important to note that these loans are first-come, first-served, the cash will run out before every eligible business receives a loan. We can help you with the application process.

Who can apply for a PPP Loan?

The following types of entities and individuals can qualify for loans through the PPP:

- Any business, nonprofit, veterans’ group, or tribal business with 500 or fewer employees

- Sole proprietors, independent contractors, and eligible self-employed workers

- Hotel and food service changes with 500 or fewer employees per location

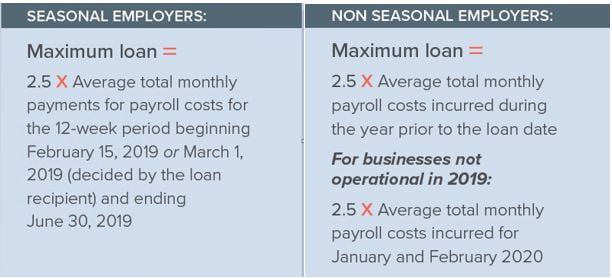

What is the maximum PPP loan amount?

PPP loans are limited to the lesser of:

- $10 million, or

- Borrower’s average monthly “Payroll Costs” multiplied by 2.5 (Method of calculation for Payroll Costs and definition of types of costs are provided below)

The interest rate for Paycheck Protection Program loans is 4.00% fixed.

“Payroll Costs” include:

- Salary, wages, commissions, payment of cash tip or equivalent

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit;

- State and local taxes assessed on compensation; and

- For a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment

“Payroll Costs” do not include the following:

- compensation of any individual employee in excess of an annual salary of $100,000 as prorated for the period February 15 to June 30, 2020;

- federal payroll taxes, railroad retirement taxes, and income taxes;

- any compensation of an employee whose principal place of residence is outside the U.S.;

- qualified sick leave wages for which a credit is allowed under section 7001 of the Families First Coronavirus Response Act (“FFCRA”); or

- qualified family leave wages for which a credit is allowed under section 7003 of the FFCRA. The FFCRA was passed on March 18, 2020.

What are loan expenditures authorized by the SBA?

Small businesses that receive loans under the PPP must use loan funds to pay the following during a cover period:

- employee salaries (including commissions and tips)

- group health premiums

- rent and utilities

- interest payments on mortgages or debt incurred before 2/15/20, not principal payments

- retirement benefits

- state or local tax assessed on compensation

- vacation, paid leave (family, medical, etc.)

Cover Period

The PPP provisions cover loans made during the covered period of February 15, 2020 through June 30, 2020 (these loans must be made during the period prior to June 30, 2020).

Unique Features

During the covered period the SBA loan program waives borrower requirements:

- inability to obtain credit elsewhere not required;

- no personal guarantee is required;

- no collateral is required; and

- there is no prepayment penalty for any payment made on a covered loan.

Instead, PPP loan applicants must make a good faith certification that:

- the loan is necessary to support the ongoing operations of the business given the uncertainty of current economic conditions;

- the loan proceeds will be used to retain workers and maintain payroll or make mortgage payments, lease payments and utility payments; and

- Between February 15, 2020 and December 31, 2020, the recipient has not received amounts under this subsection for the same purpose

Deferral

The borrower can request and receive deferment of principal, interest and fees for a period of not less than six months and not more than one year (6 months – 1 year).

Where can small business apply for this loan?

Only SBA authorized lenders can offer PPP loans. These banks have the necessary qualifications to process, close, and disburse loans. The approved lenders are now accepting applications. Its important to note that these loans are first-come, first-served, the cash will run out before every eligible business receives a loan. We can help you with the application process.

How can the PPP loan be forgiven?

The principal amount of a PPP loan will be eligible for forgiveness up to the amount of a loan that was used to pay payroll costs, mortgage interest, rent, and utilities during the 8-week period following origination of the loan.

The amount of the PPP loan that is forgiven will be subject to reduction if the borrower reduces the number of employees, employee salaries or both during the eight-week period following the origination of the loan. However, the PPP provides relief from this reduction if full-time equivalents or salaries are reinstated by June 30, 2020. To get the full benefit of loan forgiveness, businesses must keep their employees and pay them at least 75% percent of their prior-year compensation.

The SBA will purchase any loan forgiveness amounts from its certified lenders and this canceled indebtedness will not result in taxable income to the business.

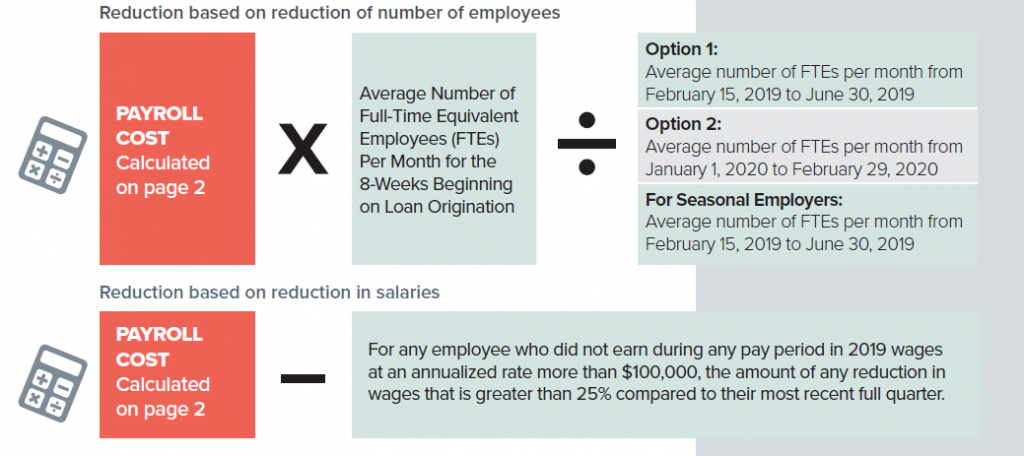

What can cause a reduction in loan forgiveness?

- Using your loan funds for another debt obligation that isn’t your payroll, rent, utilities, or mortgage interest

- Using more than 75% of your loan for rent, utilities, and/or mortgage interest

- Reducing the number of employees

- Reduction of employee wages

- Advance Payment on EIDL

The table below demonstrates how much of the loan can be reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees.

To apply for forgiveness, businesses must submit documentation regarding the eligible uses of loan funds

- Documentation verifying the number of full-time equivalent employees and relevant pay rate, including state and federal payroll and unemployment filings;

- Documentation verifying covered payroll, interest on debt obligations, leaves, and utility payments (such as, canceled checks, receipts, and account statements);

- A certification from the recipient that all documentation presented is true and correct and the amount for which the forgiveness is requested was used for permissible purposes; and,

- Any other documentation as required by the SBA.

What happens to loan amounts not forgiven?

For covered loans that have a remaining balance after the loan forgiveness reduction, the remaining balance is guaranteed by the SBA, the loan will have a maximum maturity date of 10 years from the application of loan forgiveness, and the interest rate cannot exceed 4%.