tax preparation

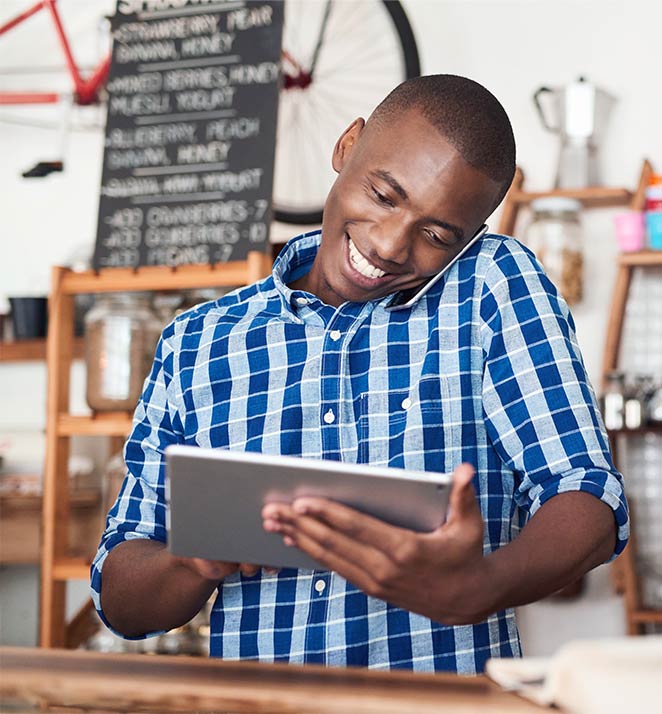

Our virtual tax preparation is as easy as 1-2-3

Our CPAs and EAs make personal & business tax filings affordable, quick, and easy. You will have everything done for you from the comfort of your home. We will ensure you are in compliance with the IRS and your State Tax agency while maximizing your tax savings.

CPA/EA Industry Experts

A CPA or EA, that is an expert in your industry and state, files your personal and business tax returns for you.

Affordable Upfront Pricing

We provide superior service without the hefty price tag. Our mission is to make professional services available to all.

Secure Online filing

All documents are exchanged through a secure portal, which also used to safely store digital copies of your returns.

Frequently Asked Questions

Need some help with a question? Click below to see if we’ve already answered it. Read more FAQs here. If you still can’t find an answer to your question, please give us a call at 866-968-4848 or email us at customerservice@eco-tax.com.

The primary benefit of virtual tax preparation is that the entire process can be completed from the comfort of your own home. Gone are the days where you need to drive out to your accountant to get taxes done. Your tax return and your supporting documents are accessible at any time at the click of a button and you can arrange to have your taxes paid or refund received electronically with an electronic signature authorization. The virtual model is designed to be accessible and easy to use so that you can get your taxes done in a timely manner with minimal effort.

Yes! The exchange of pertinent tax information is conducted through the Eco-Tax portal accessible only to you and our firm. All members are provided with a login unique to them in order to access their tax documents, tax returns, and other valuable resources.

You can sign in to your tax portal by going to www.eco-tax.com. From here you will see a “Member Login” option on the top right-hand side. Enter the credentials emailed to you from our Customer Support Team that was provided during your initial onboarding process. You cannot create your tax portal, we must provide this information for you.

What we do

Let a tax expert handle your taxes from start to finish!

Individual Income Tax Preparation

We have expertise in all of the areas of individual tax law, whether your individual tax situation is simple or complex, and prepare all federal, state, and local individual tax returns.

Self-employed & Sole Proprietors

We will use our experience to provide you with the information you need to maximize your deductions and minimize your taxes. We ensure that you are meeting all of your personal and business financial goals.

Business Income Tax Preparation

We file for all entities, including LLCs, Partnerships (1065), S-corporations (1120S), and C-Corporations(1120). An expert that specializes in small business taxes will prepare your tax returns and ensure you maximize your tax savings.

Trust, Estate, & Gift Tax Services

Our certified accountants have the expertise to file complex trusts, estate, fiduciary, and gift tax returns at the federal and state level. Our CPAs work diligently to protect your interests and meet your financial goals.

Non-Profits Tax Return Preparation

Submit required tax returns for your organization to avoid revocation of its tax-exempt status. Non-profits are generally not required to pay taxes, but they may still be required to file information returns with the IRS.

Expats & Non-Resident Tax Preparation

We serve individuals living in and outside of the U.S. Our clients include foreigners with U.S. business entities, Americans who live abroad, and those who have recently arrived in the U.S.