Economic Stimulus Checks

The Coronavirus Aid, Relief, and Economic Security (CARES) Act authorized economic stimulus checks for millions of American taxpayers.

Who is eligible for a stimulus check?

All Americans with an Social Security Number:

- that are not under 17 or claimed as a dependent

- check recipients are required to have a SSN for themselves, their spouse, and any child they claim (or an adoption taxpayer identification number)

All Social Security Recipients are also eligible:

- Individuals who are collecting Social Security benefits for retirement, disability or Supplemental Security Income will be eligible for the stimulus checks,

- their eligibility will be based on their tax returns or Social Security Administration data (information from the Form SSA-1099 Social Security Benefit Statement or Form RRB-1099 Social Security Equivalent Benefit Statement).

Note: for an eligible person to receive a check they must have either one of the following:

- a social security benefit statement, or

- a tax return filed for 2018 or 2019

If you receive social security you don’t have to file taxes to receive a stimulus check. Any person that does not receive social security benefits (stated above) and has not yet filed a 2018 or 2019 tax return will not receive a check; unless they file a 2018 or 2019 tax return as soon as possible.

Who is not eligible for a stimulus check?

- Non-resident aliens

- An adult who is claimed as a dependent on someone else’s tax return

- Anyone with income above defined income thresholds (below)

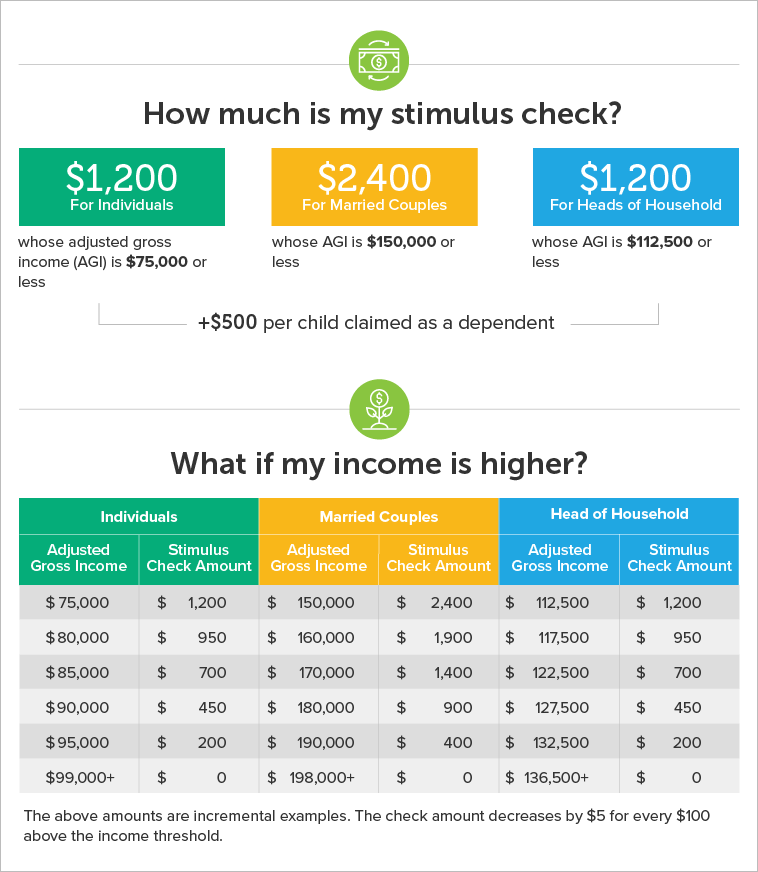

How much will these payments be?

The amount on the stimulus check will based on the person’s adjusted gross income and their tax filing status. The government will use the AGI from the filed 2019 tax return. If a 2019 tax return has not yet been filed, then payments will be based on the AGI of 2018 tax return (If your 2019 AGI qualifies you for a check then you should file as soon as possible).

- filing status single with an AGI of $75,000 or less will receive a payment of $1,200

- filing status married filing jointly with an AGI $150,000 or less will receive a payment of $2,400 payment

- filing status head of a household with an AGI $112,500 or less will receive a payment of $1,200

- the payment amount can be increased by $500 for each child claimed

The payment amounts are gradually phased out for those with higher incomes. Payments for higher income individuals would be reduced by $5 for every $100 of income above the threshold. For Example, if you are a single filer earning $75,100, your check will be $1,195 ($1,200-$5). If you are a single filer earning $80,000, your check will be $950 ($1,200-$250).

Those with the following income levels will not receive a check:

- Individuals with an AGI above $99,000,

- Joint Filers with an AGI above $198,000, or

- Head of Household with an AGI above $146,500

If these higher income earners have a lower AGI in 2020 they may be able to receive a tax credit when they file their 2020 tax return.

How will the check be sent to taxpayers?

It will be sent by direct deposit or mail. The IRS will send out notices to all recipients with information about how the payment was made and the amount of the payment.

If you have received a tax refund by direct deposit in the past two years the money will be sent to your bank account. In the next weeks, the Treasury Department plans to develop a portal for individuals to provide their banking information to the IRS online. If they do not have your banking information the IRS will mail the check to your last known address.

The details are still being worked out, but there are a few important things to know, no matter what this looks like. The government will not call to ask for your Social Security number, bank account, or credit card number. Anyone who does is a scammer. These reports of checks aren’t yet a reality. Anyone who tells you they can get you the money now is a scammer.